Accounting, Taxation and Business Advisers

Call us today: 0118 405 6000 (Local Rate)

or email us info@atbaccounting.co.uk

What size is your

business?

We know you love your business regardless of it's size, so let us offer you sound financial advice

Corporation Tax

Rates

The rates for the three financial years from 1 April 2021 are as follows:

| Year beginning 1 April: | 2021 | 2022 | 2023 |

| Corporate Tax main rate | 19% | 19% | 25% |

| Corporate Tax small profits rate | N/A | N/A | 19% |

| Marginal relief lower profit limit | N/A | N/A | £50,000 |

| Marginal relief upper profit limit | N/A | N/A | £250,000 |

| Standard fraction | N/A | N/A | 3/200 |

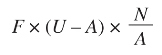

From 1 April 2023, the Corporation Tax main rate applies to profits over £250,000, and the small profits rate applies to profits of up to £50,000. Those thresholds are divided by the number of associated companies carrying on a trade or business for all or part of the accounting period. Companies with profits between £50,000 and £250,000 pay tax at the main rate reduced by a marginal relief determined by the standard fraction and this formula:

Where:

F = standard fraction

U = upper limit

A = amount of the augmented profits

N =amount of the taxable total profits

For companies with ring fence profits from oil or gas related activities, the main rate is 30%, and the small profits rate is 19%, with a ring fence fraction of 11/400, for all financial years from 2008.

Research and Development (R&D)

Small and medium (SME) companies can claim enhanced deductions for expenditure on R&D projects at 186% (230% before April 2023) of qualifying expenditure. Where the deduction is claimed and the company makes a loss, it can claim a cash credit from HMRC of 10% of that loss from 1 April 2023, previously 14.5%. Where the SME spends at least 40% of their total expenditure on qualifying R&D from 1 April 2023, it can claim the higher payable tax credit of 14.5%.

Each R&D project must be carried on in a field of science or technology and be undertaken with an aim of extending knowledge in a field of science or technology.

Research and Development Expenditure Credit (RDEC) scheme

Large companies can claim an extra 20% deduction from 1 April 2023 on the following qualifying expenditure:

- Staffing costs

- Expenditure on externally provided workers

- Software and materials consumed or transformed

- Utilities but not rent

- Payments to clinical volunteers

- Subcontractors of qualifying bodies and individuals/partnerships

RDEC differs from the previous R&D scheme for large companies as it is an 'above the line' tax credit and can be accounted for in the profit/loss statement.

For more information see our ...

Cookies are small text files that are stored on your computer when you visit a website. They are mainly used as a way of improving the website functionalities or to provide more advanced statistical data.

Cookies are small text files that are stored on your computer when you visit a website. They are mainly used as a way of improving the website functionalities or to provide more advanced statistical data.